- Take note of the qualifications conditions and you may value prior to getting a good next assets.

- The latest recent increase in More Consumer’s Stamp Responsibility (ABSD) function you’d you would like so much more bucks when purchasing one minute domestic.

- To shop for an additional property is sold with even more economic obligation; it is informed becoming obvious regarding the mission for buying the second property

With inflation dominating headlines inside current weeks, rates are ready to go up further regarding upcoming weeks. When you have been going to acquire the next property, this is often a good time to begin with searching due to the fact good boost in interest might just imply stabilisation out-of property cost.

Aside from the price of the house or property, there are some one thing you’ll should be alert to whenever purchasing an extra house, such qualifications, affordability and you may intention.

Qualification

If you very own a personal assets, you will then be absolve to pick one minute private possessions with no judge ramifications. not, in case your first home is a general public casing, whether it’s a build-to-Acquisition (BTO) apartment, resale HDB apartment, exec condo (EC), otherwise Framework, Build and sell Scheme (DBSS) apartments, then you’ll need complete certain requirements just before your purchase.

HDB apartments have good 5-seasons Lowest Job Several months (MOP) demands, which means might need to invade you to possessions having a beneficial minimum of five years before you offer or rent out your own apartment. Additionally need to fulfil the fresh new MOP before pick from a private assets.

Manage keep in mind that just Singapore owners should be able to very own both an enthusiastic HDB and you may a private property at the same time. Singapore Long lasting Customers (PRs) will have to escape of the flat within 6 months of the individual possessions buy.

Value

Homes are known to getting infamously costly into the Singapore and careful calculations have to be built to make sure your second assets buy remains sensible for your requirements loan places Belgreen area. You’d have to take notice of after the:

You’ll have to pay ABSD when you purchase the next domestic possessions. Extent you would have to pay relies on the profile.

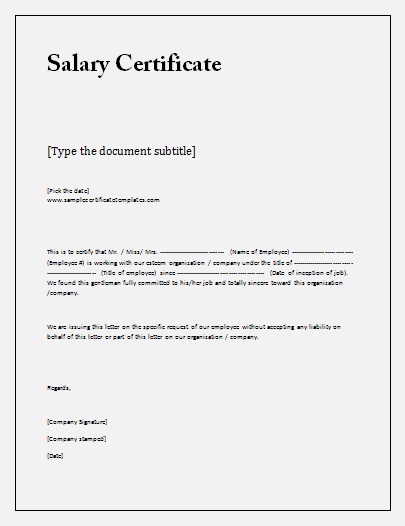

The brand new ABSD try last adjusted into included in tips to help you promote a lasting property industry. Newest costs is mirrored on table lower than:

Because of the latest ABSD prices, a beneficial Singapore Citizen whom already owns an enthusiastic HDB apartment but desires to purchase an exclusive condo costing $one million needs to pay out an enthusiastic ABSD out of $200,000 (20%). Would remember that so it count is on the upper buyer’s stamp obligation.

Your first family buy need just to 5% bucks downpayment if you took up a financial loan, but your second possessions requires a twenty-five% dollars deposit of one’s property’s valuation maximum. Provided a property which is respected at the $1 million, you would you need $250,000 dollars to possess down-payment.

The full Personal debt Servicing Proportion (TDSR) framework are introduced to end home buyers out of borrowing from the bank as well much to invest in the purchase out of a property. Beneath the framework, home buyers can just only acquire to upwards 55% (modified to your ) of the gross month-to-month earnings.

For those who have home financing tied to very first possessions buy, it does significantly impact the number you can obtain for the second house. But not, when you yourself have already cleaned the loan on the basic house, then you’ll definitely only have to make sure that your month-to-month property financing money together with any kind of month-to-month bills do not exceed 55% of your own monthly money.

For your basic construction loan, youre entitled to obtain up to 75% of the home well worth while you are trying out a financial loan or 55% should your financing tenure is more than 30 years or stretches prior years 65. For the second construction mortgage, the loan-to-worthy of (LTV) ratio falls to forty-five% to possess mortgage tenures as much as 3 decades. In case the mortgage tenure surpasses twenty five years or the 65th birthday celebration, their LTV falls so you’re able to 29%.

As you care able to see, to get another property when you’re however purchasing the mortgage away from your first home would want significantly more bucks. Predicated on a home valuation out of $one million, you’ll likely you desire:

While it is you can easily to make use of the Main Provident Money (CPF) purchasing a second property, if you have already put the CPF for you basic domestic, you can just use the additional CPF Normal Account offers to own the second assets after putting aside the present day Earliest Retirement System (BRS) regarding $96,000.

Intent

To find an extra assets is sold with way more economic obligation compared to the the first you to definitely, and is advised is clear regarding the mission getting purchasing the second possessions. Is-it having money, or could you be utilizing it just like the one minute home?

Clarifying their goal will assist you to in making specific behavior, for instance the type of possessions, in addition to opting for a place who would better suit the goal. This is certainly especially important in case your 2nd property is an investment assets.

Like any other financial investments, might need certainly to work out the possibility local rental yield and you can money prefer, in addition to influence the brand new projected profits on return. Once the property pick is a huge capital, its also wise to features a technique you to thought items such as for instance:

What is disregard the views? Can you try to bring in income after 5 years, or to keep they toward enough time-identity to gather lease?

When and exactly how will you slash loss, or no? If for example the mortgage repayments was more than the reduced leasing income, how much time can you hold on in advance of attempting to sell it off?

To get a house when you look at the Singapore was money-extreme and purchasing a moment family will require even more financial wisdom. People miscalculation might have tall financial outcomes. As such, set-up a clear package and demand an abundance think manager so you’re able to which have you are able to blind locations.

Begin Planning Now

Here are a few DBS MyHome to work out the fresh new figures and acquire a house that meets your finances and you may choices. The best part it incisions the actual guesswork.

Rather, prepare yourself that have a call at-Idea Approval (IPA), so you features confidence regarding how far you could potentially obtain having your property, allowing you to learn your allowance truthfully.