Homeownership are a search most people desire, along with unmarried mom. Whilst it may sound more complicated to possess a single mother, homeownership remains an authentic option. Sure, you should buy a property whenever you are just one mom! These eight information how solitary moms can buy a property, along with words from insights of unmarried mothers who do work in genuine estate, are a good starting point.

Believe Oneself In your New house

Make a vision panel otherwise a listing of everything you wanted on your own new house. Begin by comparing areas to have business, colleges, walkability, transport, and other things essential. Check the checklist on your fantasy community following plan good enjoying regarding available functions. They claim when you can dream it, you can do it, so open yourself to your homeownership fantasy by the immersing yourself on it. Doing so might show you what exactly is available and you can just what the present day housing market looks like.

Fantasy. Plan. Get to. You will have barriers and pressures in the act, however, are a homeowner is during your own arrived at! Keep yourself well-informed and do not hesitate to ask questions in the process. Kenise Batts , Real estate professional, and you will Mom

See What your location is

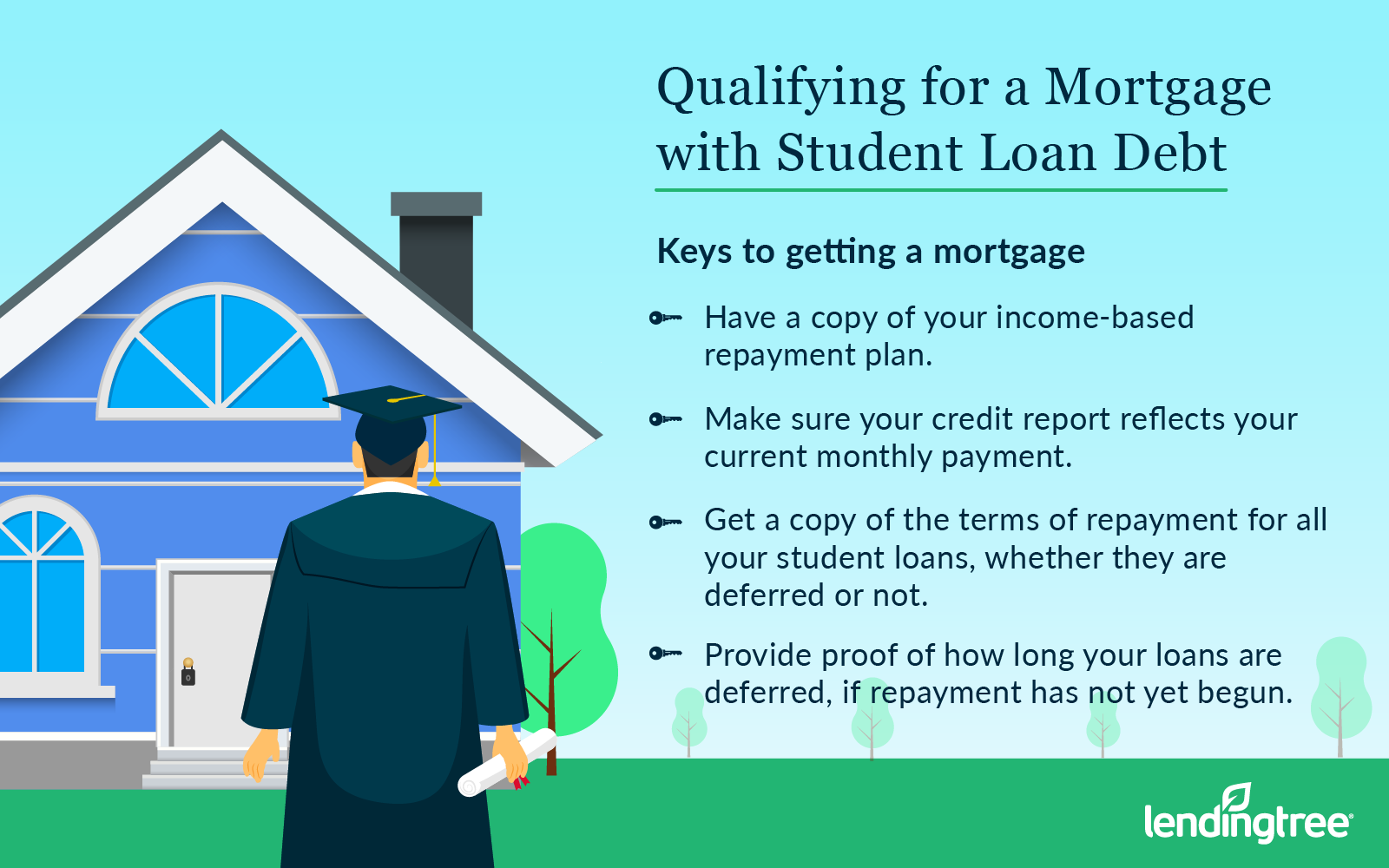

From the pull your own credit reports, you will discover where you’re for the credit score. Using home financing calculator, you can buy sensible off just how much out of an effective financial you really can afford.

You may want to functions in person with a lender otherwise borrowing from the bank union to know exactly how much away from financing and also at what rate you be considered and to rating preapproved to have a mortgage. Some people may want to begin by a real estate agent that will along with assemble this particular article. The choice is your own personal, but make sure you feel comfortable for the kids youre coping with and be aware of the terms of working with them initial. HUD likewise has information that may work for solitary moms, together with houses advisors who will consult your 100% free otherwise a nominal commission.

Budget & Save yourself

Create a resources for your newest cost of living. Lessen non-very important costs and then set those funds and you can a quantity of one’s paycheck toward a specific savings account for the future household purchase. You should consider the can cost you of buying your home, particularly devices, chairs, and repairs. Thought allocating a number of your coupons to have particular expenses that come immediately following your property purchase.

Research your facts

There is absolutely no insufficient what you should add to your quest list since the just one mother to shop for a house. Speak to your local collection to possess upcoming homeownership classes or any other info. Consider local and you will federal software and you can gives which help that have owning a home, along with earliest-day homebuyers programs. Gives come especially for solitary mothers, services users, and you can societal servants. Unmarried moms into the specific sphere s.

The art of Discussion

If you are employing a representative was created to help you on the process, it is a good idea to get to know the fresh inches and you can outs from deals when selecting a house. That it ability may come in handy if it’s for you personally to discuss finally household can cost you and you will exactly what, in the event the one thing, we want to be included prior to closure. Understanding the current market will additionally know if you will get a fair priceespecially important getting solitary mothers, and you can feamales in standard, on account of predatory means against women.

Negotiation event are extremely important when you help make instant cash loan Maine your render. Sellers might restrict their promote. Your real estate agent helps you navigate the brand new dealings. Knowing what realistic counters try ahead of time will help you to.

Different varieties of Assets

Think an effective townhouse otherwise condominium if the one-home isnt throughout the finances. Of numerous applications readily available for home buyers could also be used to help you get this assets type of. Good townhouse otherwise condo , however, each one would be pick given that a citizen. Excited, these property can be sooner or later get involved in your own wealth-building policy for all your family members. You should buy one-house and keep this one while the a bona-fide house asset.

A great Fixer Higher

A beneficial fixer-higher is even an alternative in relation to a house if for example the best or fantasy house is unavailable on the desired urban area otherwise is beyond your financial allowance. An excellent fixer-top because urban area ily on the neighborhood, particularly when it has got the facilities essential for your.

Hopefully, these suggestions and you may terminology of wisdom inform you exactly how solitary moms can be buy a house and you will prompt one to begin your homeownership journey.