A well-structured COA provides a comprehensive view of financial activities, enabling detailed analysis for informed decision-making. It aids in identifying spending trends, profitable areas, and potential savings that are crucial for strategic planning and budgeting. By adhering to these best practices, you can maximize the utility of your chart of accounts, enhancing both financial transparency and decision-making capabilities within your organization. Finally, regularly review and adjust your COA to reflect any changes in your business operations or financial reporting requirements. This ongoing adjustment ensures that your COA remains relevant and effective. Ensure that the numbering leaves room for additional accounts to be added as the business grows.

What Is General Ledger Reconciliation: Types, Best Practices and Importance

No, but it’s considered necessary by all kinds of companies seeking to categorize all of their transactions so that they can be referenced quickly and easily. This coding system is important because the COA can display many line items for each transaction in every primary account. Daniel Liberto is a journalist with over 10 years of experience working with publications such as the Financial Times, The Independent, and Investors Chronicle.

Income or Revenue represents the gains amassed from multiples sources

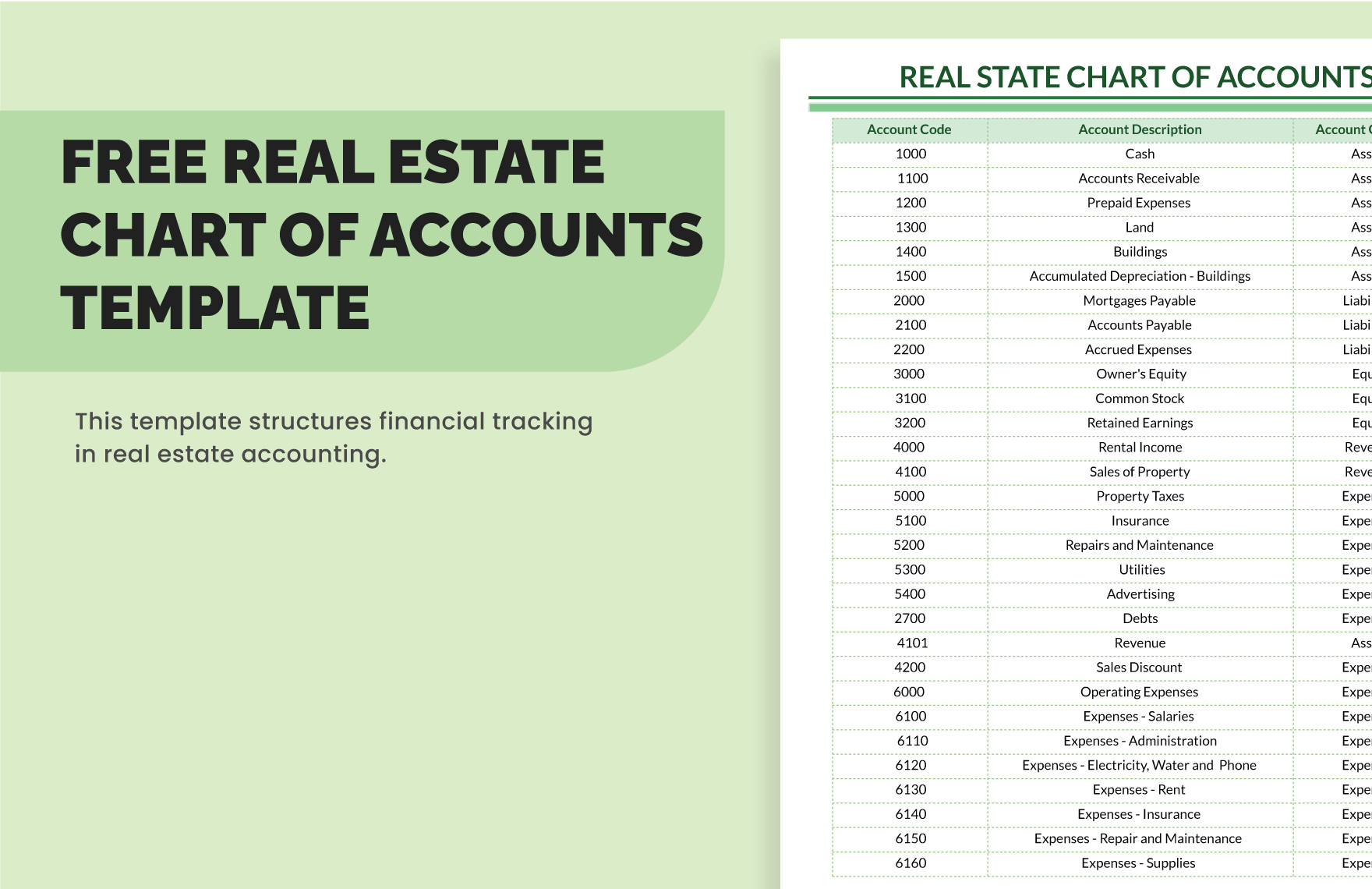

Changes to a COA in the short term can make it challenging to analyze the difference in a company’s financial health over the long term. For ease of use, a COA contains the list of accounts’ names, brief descriptions, account type, account balance and account codes for each sub-account. For example, not all accounting systems like Quickbooks include accounts for other gains and losses. When a company trades in or disposes of a vehicle, it often incurs a gain or loss on the trade or sale.

Best Free Accounting Software of 2024

For example, assume your cash account is and your accounts receivable account is 1-002, now you want to add a petty cash account. Well, this should be listed between the cash and accounts receivable in the chart, but there isn’t a number in between them. A chart of accounts is a critical tool for tracking your business’s funds, especially as your company grows. Learn how to build, read, and use financial statements for your business so you can make more informed decisions.

Here’s a deeper look at the mechanics of a COA and how it supports everyday accounting practices. With online accounting software, you can organize and track your balance sheet accounts. No matter if you’re an entrepreneur starting a business or an owner looking to streamline your practices, accounting software can help you get the job done. As your business grows, so will your need for accurate, fast, and legible reporting. Your chart of accounts helps you understand the past and look toward the future. A chart of accounts should keep your business accounting error-free and straightforward.

Sign up for latest finance stories

- Most modern accounting systems allow you to customize and expand your COA directly within the software, streamlining data entry and reporting.

- An international corporation with several divisions may need thousands of accounts, whereas a small local retailer may need as few as one hundred accounts.

- For example, assume your cash account is and your accounts receivable account is 1-002, now you want to add a petty cash account.

- Looking at the COA will help you determine whether all aspects of your business are as effective as they could be.

- Accounts may also be assigned a unique account number by which the account can be identified.

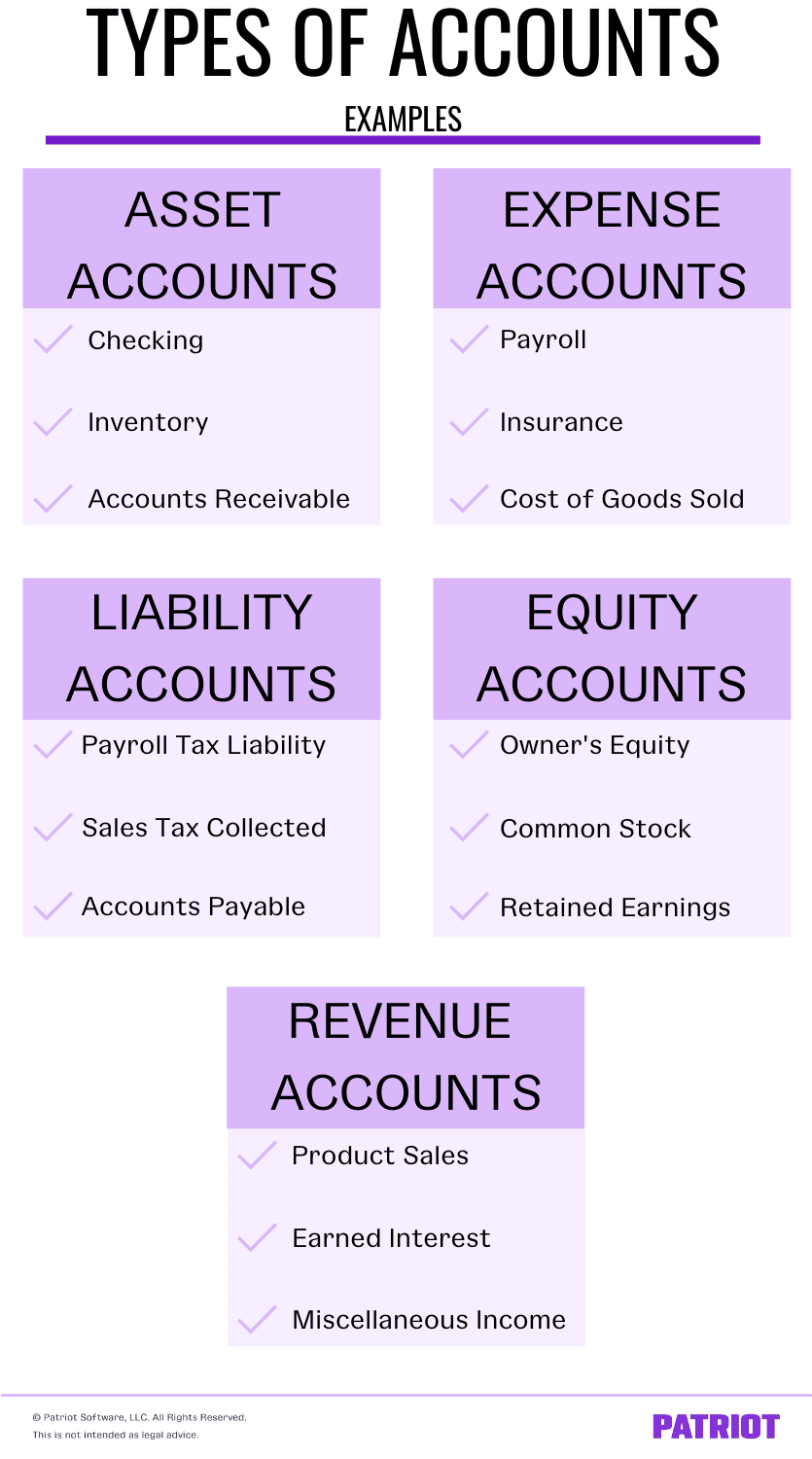

- The role of equity differs in the COA based on whether your business is set up as a sole proprietorship, LLC, or corporation.

A chart of accounts (COA) is grouped into main categories such as assets, liabilities, equity, revenue, and expenses for clear financial reporting. This categorization simplifies the preparation and analysis of financial statements, events spotlight helping organizations track their financial health efficiently. You may also wish to break down your business’ COA according to product line, company division, or business function, depending on your unique needs.

This helps in organizing the accounts systematically and simplifies the process of adding new accounts in the future. Asset accounts can be confusing because they not only track what you paid for each asset, but they also follow processes like depreciation. Second, let’s see how the journal entries feed into the general ledger which feeds into the trial balance. There are a few things that you should keep in mind when you are building a chart of accounts for your business.

The basic equation for determining equity is a company’s assets minus its liabilities. A business transaction will fall into one of these categories, providing an easily understood breakdown of all financial transactions conducted during a specific accounting period. The chart of accounts is a very useful tool for the access it provides to detailed financial information for individuals within companies and others, including investors and shareholders. Access the previously referenced link to alist of representative solutions for small and medium businesses. Accounting software will provide a spectrum of capabilities and functionality, designed for a better view of fixed assets and liabilities.