During the a property expenses, time are what you, and you can a hot seller’s market need quick approvals and reliable investment – this is where DSCR money come into. Also called money spent loans, non-QM finance, and local rental funds , DSCR financing is prominent around a residential property people looking to build their rental profiles.

Funding for rental assets assets

Investing in local rental functions has long been experienced an audio financing. That belief continues to hold correct due to the fact renter demand, occupancy accounts, leasing income growth, and you will property values soar. The current light-sizzling hot local rental market is spurring really serious and you will inexperienced home people so you’re able to size its local rental profiles.

But looking for rental functions to add to their profile simply the initial step. Accessing flexible funding and you will a reliable financial to greatly help grow your company is integral. In today’s market ecosystem, it is not easy to close for the a beneficial local rental assets price quickly instead one to.

People can clean out old-fashioned funding’s rigorous limits and you can pick good focused, goal-centered rental money debt-service coverage proportion (DSCR) loan – which provides several simple enjoys for example no hard borrowing from the bank pulls, money verifications, or tight Credit ratings so you can be considered.

What exactly is accommodations assets (DSCR) financing?

Good DSCR leasing mortgage try a challenging money, no-money mortgage originated in accordance with the property’s estimated earnings (rather than the borrower’s earnings, just as in a regular mortgage). DSCR loans give enough time-title funding to own accommodations (buy-and-hold) financing approach.

Your debt-Solution Publicity ratio (DSCR) measures what you can do to settle the borrowed funds. As opposed to a timeless otherwise manager-filled home mortgage, a DSCR mortgage isn’t underwritten based on your income. Instead, its underwritten predicated on assets-top cashflow. Like a timeless mortgage, it will take a down-payment and you may a decent credit score and you may charge annual attract.

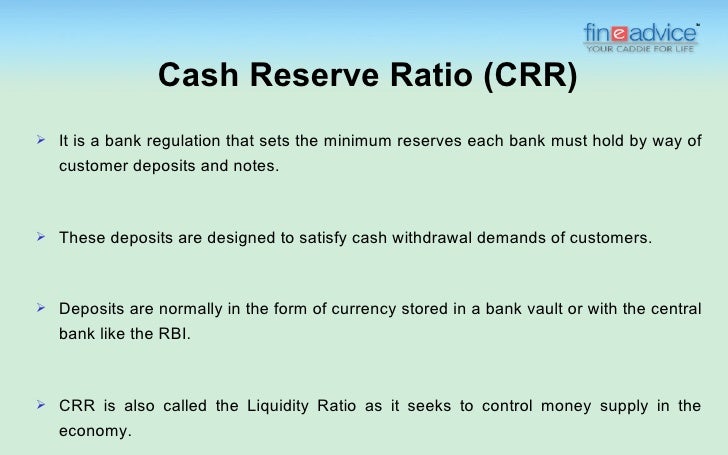

What is actually Financial obligation Solution Visibility Ratio (DSCR)?

Prior to understanding the brand new ins and outs of a rental possessions mortgage, it’s beneficial to see the calculation and you can function of your debt services coverage ratio. Lenders use this proportion to determine when you yourself have sufficient money to repay the debt. The lending company uses this informative article to decide what kind of cash to lend whenever asking for that loan or refinancing a preexisting you to.

DSCR is the proportion cash made for each $step 1 due for the financial. The greater the brand new proportion is actually, more internet working income can be obtained to help you solution the debt. Including, a-1.25x DSCR reflects the investment stimulates $1.twenty-five for each $1 owed.

Quite simply, the DSCR discusses every month-to-month financial obligation costs regarding the the house, as well as mortgage costs, and you can measures up them to this new property’s monthly revenue. The reduced the newest DSCR, the greater number of the chance you might have to go out of wallet to invest the mortgage should loans in Rico the assets sit bare, or perhaps the performing expenditures turn out to be more than asked.

DSCR calculation to possess an individual-family unit members local rental assets

An easy way in order to calculate your DSCR and you may measure your hard earned money disperse is to try to divide the fresh new monthly book of the PITIA (principal, taxes, desire, insurance policies, and you will organization fees). This new ensuing proportion lends understanding of your capability to pay back the borrowed funds predicated on the property’s month-to-month leasing money.

Note: For every single lender will features a slightly more type calculating DSCR, therefore it is better to inquire about precise numbers with your financial.

Qualifying to have a great DSCR mortgage

Whenever being qualified to have a great DSCR loan, the financial institution takes into account numerous affairs, like the borrower’s credit rating, readily available down payment, and also the debt-services coverage ratio of the house. Usually, the credit score dictates the rate, and you will leverage depends upon credit rating and you will DSCR mutual. DSCR procedures brand new asset’s capability to pay the property’s financial and you can costs – so that the highest its, more leverage the latest investor can get, and thus faster away-of-pouch cash in the closing.

- Lowest Credit score Needed: DSCR lenders like Kiavi will wanted a beneficial 660 FICO Rating to have pre-certification.

- Lowest Down payment or Security: Maximum mortgage-to-worthy of (LTV) with the leasing financing varies from financial to financial but can assortment regarding 70%-80%, according to assets method of, credit and you may DSCR. The others will be your advance payment.

- Minimum Worth of: Loan providers such as for instance Kiavi enjoys a minimum worth of dependence on $75K.

What exactly is an effective DSCR?

Lenders commonly imagine a beneficial “good” DSCR to get step one.twenty five or higher since it signifies that the property stimulates twenty-five% a lot more earnings than just expenses possesses a positive cash flow as the long because it remains filled.

The new closer you are so you’re able to cracking actually, the brand new less overall flow you can receive from the property-therefore therefore it is a good riskier resource. Put differently, in the event your DCSR into the a certain package is not about step one.0, the rental earnings are below your own overall loans services, and that means you perform generate losses per month. Because of this you will need to carry out the math on every bargain ahead of moving forward-in this case, avoiding the package may possibly end up being greatest.

Typical DSCR Mortgage Alternatives

Really tough money lenders bring repaired-speed, adjustable-speed, or focus-only solutions for the good DSCR loan. This enables you to select an informed words for the possessions price to maximize your month-to-month cashflow. Simultaneously, qualified (v) and you may ineligible (X) property brands having an excellent DSCR financing were: