Just as in of numerous categories of home buyers, very first home buyers need imagine more than just new advertised interest on their mortgage. When deciding on home financing that fits your needs, it is critical to check around and you can search in advance.

Buying a property for the first time try a phenomenon that can prove both fascinating and bravery-wracking. You want to generate an optimistic and thought decision however with such as many home loan choices for earliest home buyers on the market, this is not constantly clear and this to determine.

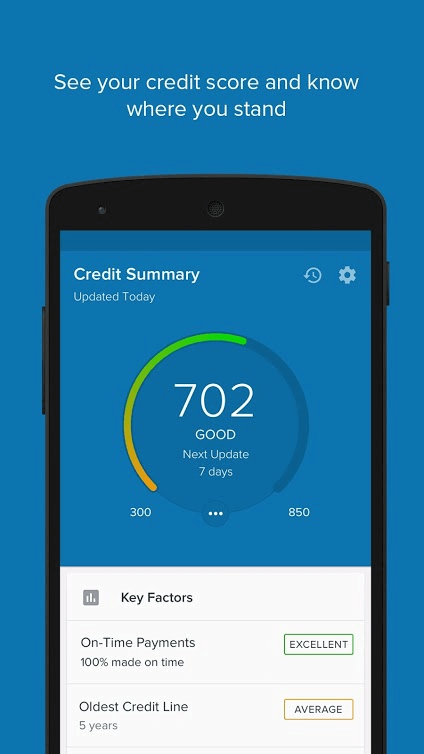

Even before you get started, try to determine whether you are in reality eligible for home financing first off. Various other wise decision would be to pay-off people highest expense you might have, such as for instance personal credit card debt, to help you increase your borrowing strength.

There are even many kinds from mortgage choices to pick. A knowledgeable mortgage to you are different according to your aim on possessions. If you are planning into the residing in the home youre securing financing having, next a proprietor-occupied mortgage is the best choice. Meanwhile, potential buyers may want a financial investment loan, that will help individuals pick real estate toward intention of making a profit with it by way of their financial support, in lieu of to reside in.

1. Dominating & notice compared to attract-simply

The rate from which you pay off the mortgage may vary. Such as, seeking a primary and you can interest financing means when it is time for you build a fees, you have to pay area of the prominent (the amount your to begin with lent) alongside the focus on that number. In contrast, an attraction-just mortgage will certainly see you pay back precisely the desire having an appartment months but be cautious performing this, although not, as your costs goes up sharply shortly after the period stops, and also you begin paying off the main in addition to desire.

Interest-simply financing are typically a lot more popular having dealers as they possibly can get renters in the, realize resource get, then we hope later on sell for a profit while maintaining their home loan repayments reasonable during that several months. Loan providers typically bring attention-100 % free symptoms so long as five years, and you will sustainable for a deeper five. Although not, speak to your private financial to ensure.

dos. Repaired vs changeable desire repayments

Financial prices can also be fixed or adjustable or, sometimes, each other. A fixed price mortgage features your payments at the an appartment desire rates across the cost months, while a variable rate transform with regards to the market speed, and therefore affecting the worth of your instalments. Another option is a partially fixed rate, and thus a portion of your loan remains fixed on good place rate, with the remaining portion within a variable rates. In this situation, you could normally decide what payment where you need to split the borrowed funds.

The fresh new partially repaired speed function you could have use of good set of extra enjoys, more than would be provided for you having an entirely fixed price financing. These characteristics include the power to keeps an offset account, and that reduces the level of notice you only pay from the tying an account fully for your paycheck with the financial, and you will an effective redraw business, which enables one to access a lot more costs you have made to help with cash flow with other, non-financial requests. Of course, you will want to weigh up the choices observe whether with more gurus caters to your particular products because you could possibly save on the mortgage because of the forgoing additional keeps.

step 3. Put standards

Usually the restriction mortgage-to-value proportion (LVR) allowable was 95%, you you would like in initial deposit of at least 5%. This will be if you don’t have an effective guarantor in the future also you into trip, then you could probably obtain 100% or even 110% of one’s property’s well worth, with regards to the financial.

Oftentimes, a 20% put otherwise 80% LVR ‘s the minimal needed to not have to pay loan providers mortgage insurance, otherwise LMI. The truth is, LMI was plans which covers the lender, perhaps not your, in the event you default. Although not, particular lenders give inexpensive or no-rates LMI when you yourself have a deposit out-of 15%.

With respect to the plan, brand new property’s really worth, and the size of their deposit, LMI will add to getting plenty otherwise 10s regarding thousands of dollars. It’s very generally rolled for the home loan, meaning you have to pay attention on the insurance coverage, too. Higher interest levels in addition to fundamentally affect high-LVR home loans, let alone the fact you may be paying rates of interest on the a bigger part of the house’s worth.

- LMI and other start up costs, together with one stamp obligation payable, can quickly reduce the measurements of the brand new put your think you got.

Very first home buyers will have to think about getting into the brand new market sooner or later with a smaller sized put, rather than saving for a longer period to save to the LMI and you may score a far more aggressive interest rate but potentially miss out on the house or property they demand. From inside the an attractive business, costs normally appreciate reduced than just earliest homebuyers can save most getting in initial deposit. Although not, inside a cold field with dropping possessions prices, a beneficial 20% deposit will bring a much bigger boundary and much more collateral.

Some loan providers keeps certain mortgage points customized so you’re able to very first homebuyers. Advantages may include shedding brand new yearly otherwise month-to-month fees to your lifetime of the loan, mortgage loan discount, or quicker onerous deposit conditions. However, the newest caveat is usually you to definitely very first home buyers subscribe to a manufactured financial.

Packed mortgage brokers, because you have suspected, bundle right up additional features for the you to definitely product. Including anything from an offset account, credit cards, insurance coverage savings, and other features. Reciprocally the initial family consumer usually pays a yearly package percentage, generally speaking to $400, however, this can change.

The bonus toward financial here is which you out of the blue has actually most of these points tied to anyone. This will make it trickier so you’re able to untangle oneself from the things when the we want to refinance. There may also be even more charge for http://elitecashadvance.com/payday-loans-in those who release off an effective packaged mortgage. This new exchange-out-of was it’s very easier, so that you will have to decide what is actually right for you here.