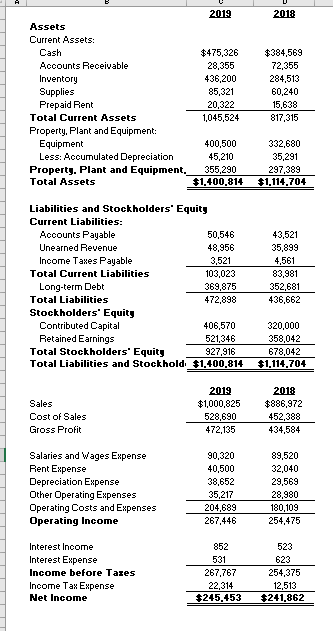

- Financial Content

- Financial Charges Fees

To find a property is costly, that it is sensible to reduce home loan charges and you may fees where you are able to. The brand new quicker you pay home based loan costs, the greater.

Of many homeowners are able to prevent expenses these charge entirely as lenders will work at special advertisements having re-finance and get rebates, zero financing handling costs, 100 % free valuation etc. even though some lenders render special discounts so you’re able to first home buyers and you will get a hold of advantages.

step 1. Charge payable within payment

- Home loan software or loan handling payment: This can be good once-out-of fee the financial institution can charge when you initially take-out financing. Which payment may differ ranging from lenders however, essentially selections anywhere between $0 in order to $800.

- Valuation percentage: After you’ve discover property, the lender would want to has a unique valuer do a beneficial valuation into property. Some loan providers commonly waive the latest valuation payment, but they are far along with anywhere between. It will cost as much as $3 hundred. We can buy a free initial valuation for your requirements with a few of our lenders.

- Settlement or business fee: Payment payment try a charge payable into the lender to fund the purchase price the financial institution runs into during the setting-up your loan. The fee ranges between $0 to $600 with regards to the bank. For individuals who opt for a professional plan, the newest payment payment is usually waived.

- Price secure fee having fixed loan: Lenders tend to ask you for an increase lock percentage if you wish to help you lock-on your own rate before the settlement go out. It allows that protected the interest cost for a good chronilogical age of ninety days. Certain fees a payment on listing of $250 to $900 while others ount.

It’s really worth pointing out one, usually, non-conforming otherwise specialist loan providers will charge highest charges compared to the significant lenders.

Loan providers Home loan Insurance rates

Loan providers Mortgage Insurance coverage (LMI) fee is actually a charge which is applicable when you acquire over 80% of the property worthy of. It’s usually the biggest violation goods prices when taking away a home loan.

The new LMI percentage grows more expensive, the greater your loan in order to value ratio (LVR) is. Including, anyone credit merely 85% of the property value may get this new LMI percentage waived or spend a number of thousand bucks, but some body borrowing from the bank 95% of the property really worth wants at the a keen LMI fee from tens of thousands of cash. You can get the latest LMI payment waived having a good guarantor family financing.

dos. Charges that implement for the identity of one’s mortgage

- Ongoing costs: There is certainly constant fees instance annual costs, month-to-month membership-staying fees. It could be a great $fifteen monthly fee or an annual $395 payment. Although it will most likely not seem like much initially, given you will need to pay $395 on a yearly basis, they adds up to $eleven,850 more a thirty-year mortgage label. So it currency can be best saved up on your membership.

- Late payment fees: Late payment charges was charges recharged after you miss the cost deadline from the four working days. The newest charges are continuously charged if you do not pay all the arrears or go into a cost bundle together with your bank. This new later payment charge might be ranging from $20 so you can $fifty monthly.

step 3. Charges to own financial has actually

Mortgage brokers these days are very customisable, you might choose the advantages you need. not, they arrive which have fees, so you should imagine even if these are typically worth the costs.

- A lot more payments: A lot more money usually are 100 % free. Using this function, you’ve got the power to make even more repayments into the mortgage on top of the minimal financing repayment. Expenses actually a bit most anytime means you pay from the financing much before and relieve the eye recharged more the life of the mortgage. Elizabeth.g. When you yourself have good $400,000 loan at the mortgage out-of step 3% (30 season), and you also build more costs away from $2 hundred payday loan Waterloo month-to-month into your financing, it is possible to repay the loan number of years and you may nine months prior to, and you will cut up to $thirty six,000 in notice.